We're Making Things Better

CardNitty is undergoing a major revamp. We'll be back soon with an improved experience.

Staff Access

Use your fingerprint, face, or device PIN to authenticate.

Questions? Email us at support@cardnitty.com

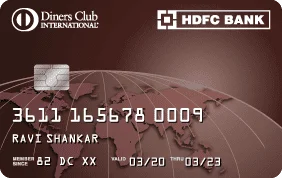

Maximum spending power with the highest credit limits available. Ideal for high spenders and big-ticket purchases.

274 cards ranked | Updated February 2026

Highest possible limit

Minimum upon approval

Predictable range

Limit vs annual fee

₹5.0L

₹5.0L

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Higher credit limits provide more spending flexibility and can improve your credit utilization ratio (keeping it under 30% is ideal). Premium cards often offer limits of ₹10L+ for qualified applicants.

Banks consider your income, credit score, existing credit obligations, relationship history, and the card type. Premium cards reserved for high-income applicants naturally offer higher limits.

High credit limits matter for big spenders and credit score optimization. However, having a high limit you don't need provides little benefit—focus on cards matching your actual spending patterns.