We're Making Things Better

CardNitty is undergoing a major revamp. We'll be back soon with an improved experience.

Staff Access

Use your fingerprint, face, or device PIN to authenticate.

Questions? Email us at support@cardnitty.com

Annual Fee

₹1,499

Rewards/₹100 ⓘ

₹0.25 - ₹1.25

Interest Rate

42.00%

Credit Score

750+

Key Benefits

5X rewards on medical/travel, Rs. 20L indemnity, 12 lounges

Lounge Access

8 domestic + 4 international via Priority Pass per year

Eligibility

Allopathic doctors, 3+ yrs experience, age 21-65, CIBIL 750+

The Doctor's SBI Card (IMA) is a niche credit card uniquely designed for medical professionals. Its standout feature is the Rs. 20 Lakh professional indemnity insurance, which is unmatched by any other credit card in India. Combined with solid lounge access benefits and accelerated rewards on medical supplies and travel, it offers good value for doctors who can meet the Rs. 2 Lakh annual spend threshold for fee waiver.

Best For

Practicing doctors who travel frequently and want professional indemnity insurance coverage

Not Ideal For

Non-doctors, low spenders, those seeking high cashback rates

visits per year

Max 2 visits per quarter via Visa/DreamFolks

visits per year

Max 2 visits per quarter, $27+tax per visit after

All Spends

Medical Supplies

Travel

International

Doctor's Day (1st July)

Fuel

Grocery

Dining

Shopping

Utility Bills

Redeem your Reward Points for cashback, travel, and more

Statement Credit

E-Gift Vouchers

SBI Card Reward Catalogue

Welcome e-Gift Voucher worth Rs. 1,500 from Yatra.com on membership fee payment

value

Renewal fee of Rs. 1,499 reversed on annual spends of Rs. 2 Lakhs

Spend ₹2,00,000 within 365 days

value

E-Gift Voucher worth Rs. 5,000 from Yatra.com/Bata/Shoppers Stop on achieving annual spends of Rs. 5 Lakhs

Spend ₹5,00,000 within 365 days

value

Dining

Exclusive benefits at 900+ luxury hotels worldwide via Visa Signature privileges

Travel Desk

35.00% off

Up to 35% off on Avis Car Rentals, 10% on Hertz Car Rental

Custom

20.00% off

20% discount on Airport Fastrack Immigration at 450+ destinations

See how this card performs in different spending categories compared to other cards.

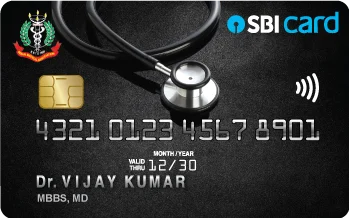

The Doctor's SBI Card (IMA) is a unique credit card exclusively designed for medical professionals, issued in association with the Indian Medical Association (IMA). It is the only credit card in India associated with IMA, the largest representative voluntary organisation of Doctors of Modern Scientific System of Medicine.

This card combines professional benefits like indemnity insurance with lifestyle perks including airport lounge access, accelerated rewards on medical supplies and travel, and Visa Signature privileges. With an annual fee of Rs. 1,499, it offers solid value for doctors who travel frequently and want financial protection for their practice.

The Doctor's SBI Card (IMA) is a Visa Signature credit card issued by SBI Cards and Payment Services Limited in partnership with the Indian Medical Association. It is specifically designed for allopathic doctors with at least 3 years of practice experience.

The standout feature of the Doctor's SBI Card is its Professional Indemnity Insurance cover of Rs. 20 Lakhs. This covers legal and defense costs, out-of-court settlement expenses, and court awards with 0% deductible from the Sum Insured. This is invaluable for medical professionals who face litigation risks in their practice.

Earn accelerated 5X Reward Points (worth Rs. 1.25 per Rs. 100) on three key categories:

All other purchases earn 1 Reward Point per Rs. 100 spent (0.25% reward rate). Points can be redeemed as statement credit at 4 RP = Rs. 1.

Enjoy 12 complimentary airport lounge visits per year:

Get 1% fuel surcharge waiver at all petrol pumps across India on transactions between Rs. 500 and Rs. 4,000, with a maximum waiver of Rs. 250 per statement cycle.

The Doctor's SBI Card (IMA) provides comprehensive airport lounge access across domestic and international airports.

Note: Lounge access is available only for the primary cardholder. Call SBI Card helpline at 1860 180 1290 to receive your Priority Pass.

The Doctor's SBI Card uses SBI Rewardz program for its rewards:

Reward redemption fee of Rs. 99 applies on physical products and physically delivered vouchers. Points are valid for 24 months from the date of earning.

| Fee Type | Amount |

|---|---|

| Joining Fee (one-time) | Rs. 1,499 + GST |

| Renewal Fee (per annum) | Rs. 1,499 + GST (waived on Rs. 2L annual spend) |

| Add-on Card Fee | Nil |

| Finance Charges | 3.5% per month (42% per annum) |

| Interest-Free Period | 20 to 50 days |

| Cash Advance Fee | 2.5% or Rs. 500, whichever is higher |

| Foreign Currency Transaction Fee | 3.5% |

| Over Limit Fee | 2.5% of over-limit amount or Rs. 600, whichever is higher |

| Late Payment | Rs. 0 - Rs. 1,300 (tiered based on outstanding) |

| Payment Dishonor Fee | 2% of payment amount, minimum Rs. 500 |

| Card Replacement Fee | Rs. 100 - Rs. 250 |

| Reward Redemption Fee | Rs. 99 (on physical products and vouchers) |

| Rent Payment Fee | Rs. 199 per transaction |

| Cash Payment Fee | Rs. 250 + taxes at SBI branches |

| Statement Retrieval Fee | Rs. 100 per statement (older than 2 months) |

| Cheque Payment Fee | Rs. 200 |

Only the primary cardholder needs to be a doctor. Add-on cards can be issued to family members (spouse, parents, siblings, children above 18) who are not doctors. Up to 5 add-on cards can be issued.

Track your application status on the SBI Card website under the "Track Application" section using your application number. You can also call the helpline at 1860 180 1290.

The Doctor's SBI Card (IMA) fills a unique niche in the Indian credit card market as the only card associated with the Indian Medical Association. Its standout feature remains the Rs. 20 Lakh Professional Indemnity Insurance cover, which alone can justify the Rs. 1,499 annual fee for practicing doctors who would otherwise need to purchase such coverage separately.

The card offers a solid package with 12 complimentary airport lounge visits, Priority Pass membership, and accelerated rewards on categories relevant to medical professionals. However, the base reward rate of 0.25% is on the lower side, and the 3.5% forex markup diminishes the value of 5X international rewards. For doctors who spend Rs. 2 Lakhs annually, the fee waiver makes this essentially a free card with valuable insurance coverage.

Overall, this card is best suited for practicing allopathic doctors who value professional insurance coverage and travel benefits, especially those who are IMA members and want a card that reflects their professional identity.

Last updated: 1 February 2026

Get started with your application today and enjoy premium benefits, rewards, and exclusive privileges.

Apply Now on SBI Cards Apply Now