We're Making Things Better

CardNitty is undergoing a major revamp. We'll be back soon with an improved experience.

Staff Access

Use your fingerprint, face, or device PIN to authenticate.

Questions? Email us at support@cardnitty.com

Annual Fee

₹1,000

Rewards/₹100 ⓘ

₹0.50 - ₹0.67

Interest Rate

41.88%

Credit Score

750+

Key Benefits

3 RP/Rs.150, 50% dining bonus, Rs.20L indemnity insurance

Lounge Access

No complimentary lounge access

Eligibility

Indian doctors, age 21-65, CIBIL 750+

The HDFC Doctors Superia Credit Card is a purpose-built card for medical professionals offering a unique professional indemnity insurance benefit that no other card provides. While the reward rates are modest and lounge access is absent, the low annual fee, dining bonus, and insurance coverages make it a practical choice for doctors. However, since the card is no longer available for new applications, existing cardholders should continue to maximise its benefits.

Best For

Medical professionals who want a dedicated credit card with professional indemnity insurance, dining rewards, and air miles conversion.

Not Ideal For

Non-doctors (card is exclusively for medical professionals), those seeking lounge access, or those wanting high reward rates on general spending.

All Spends

Dining

Insurance Transactions

Redeem your points for cashback, travel, and more

Singapore Airlines KrisFlyer

667 Reward Points = 100 KrisFlyer miles. Redeemable for flights on 20+ international airlines.

Air Voucher

Spend Rs.5 lakh annually and redeem points for air voucher worth Rs.8,000 or equivalent air miles.

HDFC Rewards Catalogue

Redeem for gifts and vouchers from the exclusive HDFC Bank rewards catalogue.

1,000 Reward Points on payment of joining fee.

value

1,000 Reward Points on annual card renewal.

value

First year joining fee reversed on spending Rs.15,000 within 90 days of card setup.

Spend ₹15,000 within 90 days

value

Annual fee of Rs.1,000 waived on spending Rs.1 lakh in the previous year.

Spend ₹1,00,000 within 365 days

value

Air voucher worth Rs.8,000 or corresponding air miles on annual spend of Rs.5 lakh or more.

Spend ₹5,00,000 within 365 days

value

Dining

50.00% off

50% more Reward Points on all restaurant dining spends (MCC classified as Restaurant only).

Dining

40.00% off

Up to 40% off at participating restaurants via The Good Food Trail by HDFC Bank.

See how this card performs in different spending categories compared to other cards.

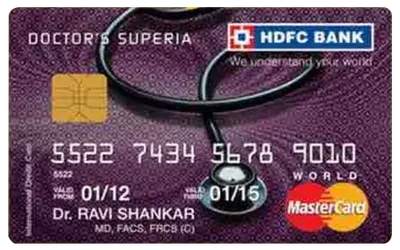

The HDFC Bank Doctors Superia Credit Card is a reward-based credit card exclusively designed for medical professionals. It offers accelerated reward points, special dining benefits, and unique professional indemnity insurance coverage that makes it stand out among credit cards for doctors.

Note: Sourcing of this credit card has been stopped by HDFC Bank. Existing cardholders continue to enjoy all benefits.

The HDFC Doctors Superia Credit Card is a mid-range credit card from HDFC Bank, specifically created for Indian doctors including both salaried and self-practicing medical professionals. It combines everyday reward earning with specialised insurance benefits tailored for the medical profession.

Earn 3 Reward Points for every Rs.150 spent on eligible retail purchases. Only retail transactions qualify; cash advances, fees, and other charges do not accrue points. Transactions below Rs.150 do not earn any Reward Points.

Enjoy 50% more Reward Points when you dine at restaurants. This bonus applies only to transactions classified under the Restaurant Merchant Category Code (MCC) by Visa/MasterCard. Hotel category MCCs do not qualify for this bonus.

The card provides three types of insurance:

1% fuel surcharge waiver at all fuel stations across India on transactions between Rs.400 and Rs.5,000. Maximum waiver capped at Rs.250 per statement cycle. GST on fuel surcharge is not refundable.

Convert Reward Points to Singapore Airlines KrisFlyer miles at 667 Reward Points = 100 KrisFlyer miles. Redeemable for flight tickets on over 20 international airlines or any major domestic airline.

The HDFC Doctors Superia Credit Card does not offer complimentary airport lounge access. Cardholders seeking lounge access benefits may consider upgrading to the HDFC Doctors Regalia Credit Card which offers superior travel benefits.

Earn 3 Reward Points for every Rs.150 spent on eligible retail purchases. Restaurant dining earns 50% more points (approximately 4.5 RP per Rs.150). Insurance transactions are capped at 2,000 RP per transaction.

Reward Points are valid for 2 years from the date of accumulation.

| Fee Type | Amount |

|---|---|

| Joining Fee | Rs.1,000 + GST (reversed on Rs.15,000 spend in 90 days) |

| Annual Fee | Rs.1,000 + GST (waived on Rs.1 lakh annual spend) |

| Interest Rate | 3.49% per month (41.88% p.a.) |

| Late Payment Fee | Rs.0 to Rs.1,300 (tiered by outstanding amount) |

| Cash Advance | 2.5% or Rs.500, whichever is higher |

| Over Limit Fee | 2.5% or Rs.500, whichever is higher |

| Foreign Currency Markup | 3.5% of transaction amount |

| Fuel Surcharge Waiver | 1% on Rs.400-5,000 txns, max Rs.250/cycle |

| Minimum Due | 5% or Rs.200, whichever is greater |

Note: This card is no longer available for new applications. Sourcing has been stopped by HDFC Bank.

The HDFC Doctors Superia Credit Card is a well-designed credit card that addresses the specific needs of medical professionals in India. Its standout feature is the Professional Indemnity Insurance covering professional negligence up to Rs.20 Lakh, a benefit not found on most other credit cards.

With a low annual fee of Rs.1,000 (easily waivable), decent reward earning on dining, and comprehensive insurance coverages including Rs.50 Lakh accidental death cover, it offers genuine value for its target audience. However, the lack of lounge access and modest base reward rates are areas where it falls short compared to premium cards. Since the card is no longer available for new applications, existing cardholders should maximise its benefits while they last.

Last updated: 15 February 2026

Get started with your application today and enjoy premium benefits, rewards, and exclusive privileges.

Apply Now on HDFC Bank Apply Now