We're Making Things Better

CardNitty is undergoing a major revamp. We'll be back soon with an improved experience.

Staff Access

Use your fingerprint, face, or device PIN to authenticate.

Questions? Email us at support@cardnitty.com

Annual Fee

₹500

Rewards/₹100 ⓘ

₹0.27 - ₹0.40

Interest Rate

41.88%

Credit Score

700+

Key Benefits

3X weekend rewards, Rs. 50L insurance, fuel waiver

Lounge Access

No lounge access available

Eligibility

Teachers only, age 21-60 (salaried), CIBIL 700+

The HDFC Teachers Platinum Credit Card is a solid entry-level card specifically designed for educators. While the base reward rate is modest, the 3X weekend acceleration and Teachers Day bonus make it unique. The standout feature is the Rs. 50 Lakh accidental death insurance at a very low annual fee of Rs. 500, making it excellent value for teachers who want basic credit card benefits with insurance coverage.

Best For

Teachers looking for a low-fee credit card with weekend bonus rewards, Teachers Day special benefits, and accidental death insurance coverage.

Not Ideal For

Non-teachers who cannot apply, frequent international travelers due to high 3.5% forex markup, and users seeking premium lounge access or high reward rates.

All Spends

Shopping

Teachers Day Bonus (5th September)

Redeem your points for cashback, travel, and more

HDFC Rewards Catalogue

Flight/Hotel Bookings

Gift Vouchers

Annual fee waiver on spending Rs. 50,000 in anniversary year

Spend ₹50,000 within 365 days

value

500 bonus reward points on Teachers Day (5th September) every year as gift from HDFC Bank

value

Free Accidental Death Insurance up to Rs. 50 Lakhs on making minimum 4 transactions per month

value

See how this card performs in different spending categories compared to other cards.

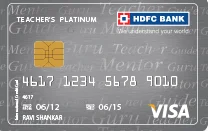

The HDFC Teachers Platinum Credit Card is a premium credit card designed exclusively for educators in India. Offered by HDFC Bank, this card recognizes the valuable contribution of teachers by providing a tailored set of benefits including accelerated weekend rewards, a special Teachers Day bonus, and comprehensive accidental death insurance coverage.

With a low annual fee of just Rs. 500 (waivable on Rs. 50,000 annual spend), this card delivers solid value for teachers who want to earn rewards on everyday purchases while enjoying essential financial protection. The card is available to both salaried and self-employed teachers across India.

The HDFC Teachers Platinum Credit Card is a Visa Platinum credit card issued by HDFC Bank exclusively for the teaching community in India. It offers a reward-based system where cardholders earn points on every purchase, with enhanced earning rates during weekends.

Earn 2 reward points for every Rs. 150 spent on weekday purchases. During weekends (Saturday and Sunday), enjoy 3X accelerated rewards earning 6 points for every Rs. 150 spent. This makes the card particularly rewarding for weekend shoppers.

Every year on 5th September (Teachers Day), HDFC Bank gifts 500 bonus reward points to all Teachers Platinum cardholders as a special gesture of appreciation.

Make at least 4 transactions per month to qualify for free Accidental Death Insurance coverage of up to Rs. 50 Lakhs for the primary cardholder. Additionally, get Rs. 5,000 protection against fire and burglary for goods purchased using the card, valid for 180 days from purchase.

The standard fuel surcharge of 2.5% plus service tax is replaced by a convenience fee of only 1% on fuel transactions between Rs. 400 and Rs. 5,000. The maximum fuel surcharge waiver is capped at Rs. 250 per billing cycle, potentially saving up to Rs. 1,500 annually on fuel purchases.

Get up to 3 lifetime-free add-on credit cards for parents, spouses, children, and siblings above 18 years of age. All add-on cards share the same credit limit and earn reward points.

In case of card loss, report immediately to HDFC Bank customer care and you will not be held liable for any fraudulent transactions made after reporting.

Enjoy up to 50 days interest-free period on all purchases when you pay your full outstanding balance before the due date.

Spend Rs. 50,000 or more in your anniversary year and the annual renewal fee of Rs. 500 will be waived for the next year.

Every year on 5th September, receive 500 bonus reward points as a special Teachers Day gift from HDFC Bank.

Make at least 4 transactions per month using the card to activate free Accidental Death Insurance coverage of up to Rs. 50 Lakhs for the primary cardholder, plus Rs. 5,000 fire and burglary protection for purchased goods.

The HDFC Teachers Platinum Credit Card does not include any domestic or international airport lounge access benefits. If lounge access is important to you, consider upgrading to premium HDFC Bank credit cards like the Regalia or Infinia.

The HDFC Teachers Platinum Credit Card offers a straightforward reward points system:

All reward points are valid for 2 years from the date of accumulation. Points not redeemed within this period will expire automatically.

Reward points can be redeemed through HDFC Net Banking or offline by mailing the redemption form. Options include:

A redemption fee of Rs. 99 is charged per redemption request.

| Fee Type | Amount |

|---|---|

| Joining Fee | Rs. 500 + GST |

| Annual Fee | Rs. 500 (waived on Rs. 50,000 annual spend) |

| Interest Rate | 3.49% per month (41.88% per annum) |

| Interest-Free Period | Up to 50 days |

| Cash Advance Fee | 2.5% or Rs. 500, whichever is higher |

| Cash Advance Limit | 40% of credit limit |

| Late Payment (up to Rs. 100) | Nil |

| Late Payment (Rs. 101-500) | Rs. 100 |

| Late Payment (Rs. 501-1,000) | Rs. 500 |

| Late Payment (Rs. 1,001-5,000) | Rs. 600 |

| Late Payment (Rs. 5,001-10,000) | Rs. 750 |

| Late Payment (Rs. 10,001-25,000) | Rs. 900 |

| Late Payment (Rs. 25,001-50,000) | Rs. 1,100 |

| Late Payment (above Rs. 50,000) | Rs. 1,300 |

| Over Limit Fee | 2.5% of over-limit amount, min Rs. 500 |

| Foreign Currency Markup | 3.5% |

| Card Replacement | Rs. 100 |

| Reward Redemption Fee | Rs. 99 per request |

| Balance Transfer Fee | 1% or Rs. 250, whichever is higher |

| Cash Processing Fee | Rs. 100 per transaction |

| Railway Booking Fee | 1.8% + GST |

| Cheque Return Fee | 2% of amount, min Rs. 450 |

| Fuel Surcharge Cap | Rs. 250 per billing cycle |

| Minimum Repayment | 5% or Rs. 200, whichever is higher |

This card is exclusively available for teachers. The applicant must be a salaried or self-employed teacher to be eligible.

The applicant must be a resident or non-resident Indian (NRI).

A good CIBIL score of 700 or above is recommended for approval. A higher credit score improves chances of approval and may result in a higher credit limit.

The HDFC Teachers Platinum Credit Card is a well-designed, low-fee credit card that recognizes and rewards the teaching profession. With an annual fee of just Rs. 500 (waivable), it offers a compelling package of weekend accelerated rewards, a unique Teachers Day bonus, and one of the most generous insurance coverages in the entry-level segment at Rs. 50 Lakhs.

While it lacks premium features like lounge access, high reward rates, or low forex markup, it delivers excellent value for teachers who primarily spend domestically. The 3X weekend rewards make it particularly useful for weekend shopping, and the fuel surcharge waiver adds to daily savings. For educators looking for their first or primary credit card with solid insurance benefits, this card is a strong contender in the budget segment.

Last updated: 12 February 2026

Get started with your application today and enjoy premium benefits, rewards, and exclusive privileges.

Apply Now on HDFC Bank Apply Now