If you want to increase CIBIL score immediately and are unaware about what CIBIL Score is, why it matters, how it works and how to increase it. You have come to the right place. In this comprehensive guide, we will explore effective strategies to increase your CIBIL score immediately.

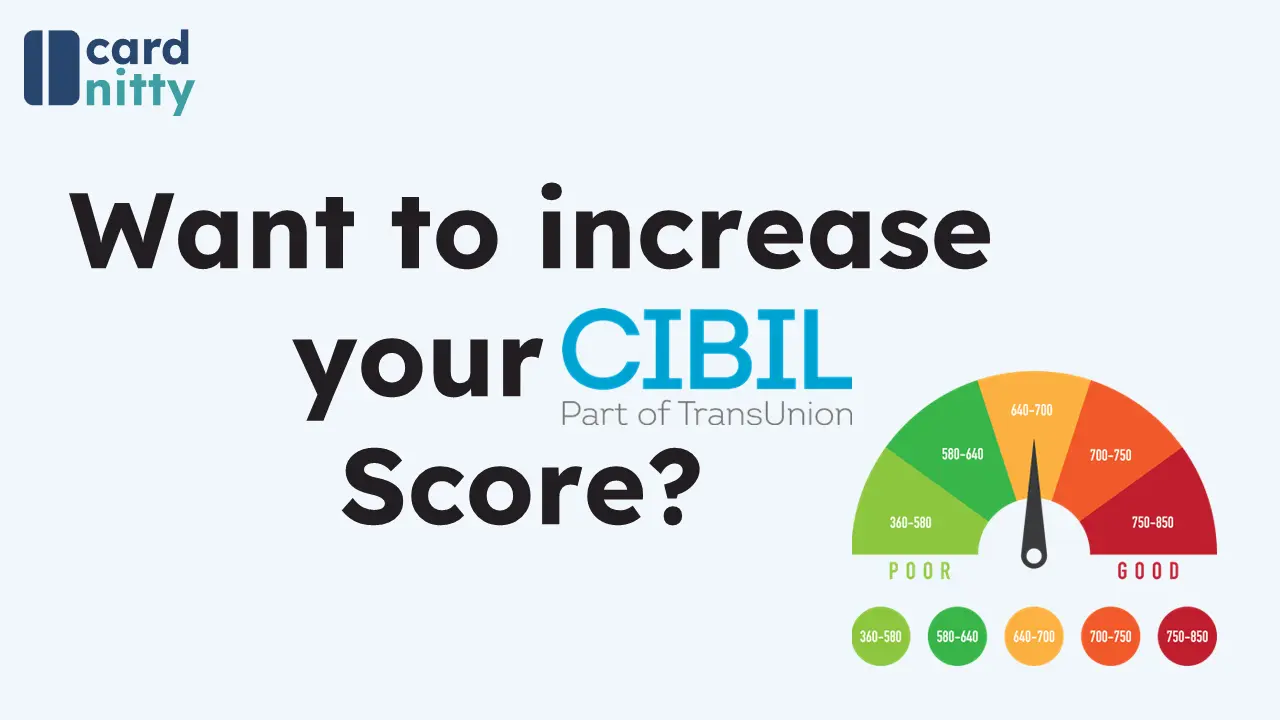

In India, most banks rely on CIBIL Score for understanding credit worthiness of their target customers and also to decide on whether they want to offer their credit products & services to them. CIBIL Score is a credit score operated by TransUnion CIBIL which is a credit information bureau in India. It keeps track of credit goodwill of all individuals with a credit history. There are other Credit Information Bureaus as well such as, Experian & CRIF. Yet, CIBIL is the most relied upon in India.

Personal Experience (Can Skip) – I have a very vivid memory of my first ever credit card application. I was new at my job and a bank executive had visited my workplace for salary account KYC. He asked me if I would be interested in a getting a credit card. I was like sure, only to find out 10 days later that my credit card application was rejected due to lack of a credit history or a good credit score. I had so little knowledge or understanding about it. Unfortunately, In India most youngsters have very little understanding of the importance of credit scores and what factors impact this 3-digit scale of creditworthiness.

Understanding CIBIL Score

Before we dive into the ways to improve your CIBIL score, let’s first understand what it is and why it’s important. Your credit score plays a crucial role in your financial life as a good credit score not only helps you qualify for loans and credit cards but also affects the interest rates and terms you’ll receive for the same.

What is a CIBIL Score?

A CIBIL score, also known as a credit score, is a three-digit number that represents your creditworthiness. In India, credit scores are provided by credit bureaus, with TransUnion CIBIL being one of the prominent ones. Your CIBIL score is based on your credit history and financial behavior, including your repayment history, credit utilization, length of credit history, and types of credit accounts.

Why is CIBIL Score Important?

Your CIBIL score is used by lenders to assess your credit risk. A higher score indicates lower risk, making you more attractive to lenders. Here’s why your CIBIL score matters:

- Loan Eligibility: A high CIBIL score increases your chances of loan approval. A better score is a proof of a good credit history. The fact that you paid your past loans and dues well on time and never defaulted. Gives somewhat of an assurance that you would not default their loans.

- Lower Interest Rates: You’ll qualify for loans and credit cards with lower interest rates, saving you money. A better credit score demonstrates lower risk of default, due to which banks are willing to offer better rates.

- Faster Loan Approval: Lenders are more likely to fast-track your loan application with a good credit score. A good credit history reduces the effort required at bank’s end to investigate the legitimacy of your income sources and you ability to repay on time. This saves time in loan processing and usually leads to faster approvals.

- Higher Credit Limits: You can access higher credit limits on your credit cards. As you always pay well on time and never default, banks are comfortable to offer you better credit limits by increasing it gradually over time.

Now that you understand the importance of your CIBIL score, let’s explore ways to boost it immediately.

Tips to Increase CIBIL Score Immediately

1. Review Your Credit Report

The first step in improving your CIBIL score is to review your credit report for inaccuracies. Errors in your credit report can negatively impact your score. Obtain a free copy of your credit report from the credit bureaus and check it for any discrepancies.

2. Pay Your Bills on Time

One of the most crucial factors affecting your CIBIL score is your payment history. Ensure that you pay all your bills, including credit card bills and loan EMIs, on time. Late payments can significantly damage your credit score.

3. Reduce Credit Card Utilization

High credit card balances relative to your credit limit can harm your credit score. Aim to keep your credit card utilization below 30%. Paying down credit card debt can quickly improve your CIBIL score.

4. Avoid Multiple Credit Applications

Each time you apply for a loan or credit card, it results in a hard inquiry on your credit report. Too many inquiries can signal financial distress to lenders. Minimize credit applications, especially if your score needs improvement.

5. Diversify Your Credit Mix

A diverse credit mix that includes both revolving credit (credit cards) and installment credit (loans) can positively impact your CIBIL score. If you don’t have a mix of credit accounts, consider diversifying your credit portfolio.

6. Settle Outstanding Debts

If you have any outstanding debts or loans in collections, consider settling them. Once settled, ask the creditor to update your credit report to reflect the payment. This can help improve your score.

7. Avoid Closing Old Accounts

The length of your credit history matters. Keep your older credit accounts open and in good standing, as they contribute positively to your credit score.

8. Regularly Monitor Your CIBIL Score

Monitoring your CIBIL score regularly helps you track your progress and detect any issues early. Many credit bureaus offer free credit score monitoring services.

9. Seek Professional Help

If you’re facing difficulties in managing your debt and improving your credit score, consider consulting a credit counseling agency or a financial advisor. They can provide tailored guidance to address your specific financial situation. At Card Nitty, we offer professional help in managing your credit score, feel free to reach out to us on contact@cardnitty.com.

Conclusion

Your CIBIL score is a vital financial indicator, and taking steps to increase it immediately can open up various financial opportunities. By following these tips and adopting responsible financial habits, you can not only improve your credit score but also enhance your overall financial well-being. Remember that improving your CIBIL score takes time and discipline, so stay committed to the process, and you’ll reap the benefits in the long run.